When it comes to borrowing money, lenders want to have a level of trust that you will be able to pay it back. Secured loans are a way for people to borrow a sum of money, which is secured against an asset such as a property over 3 to 35 years. Like a mortgage, this method of borrowing means that if you fail to keep up with the repayments of the loan, the lender can take possession of the property you secured the loan against.

Secured loans can offer a range of advantages and disadvantages.

To help determine whether a secured loan is right for you, we have put together our no-nonsense guide to secured loans to help you make an informed decision.

Before searching for secured loans or any other form of a loan, it is worthwhile getting a credit report. You need to know what your credit score says about you, and if there are any issues that you can fix before potential lenders look at it. A broker like Lending Expert will carry out a soft credit search in order to find potential lenders before making a formal application.

What is a secured loan?

Like your mortgage, a secured loan is a loan that requires you to provide a level of security to the lender so that they will not lose out financially if you cannot repay the loan. Usually, the asset used for security will be a home, which is why secured loans can often be referred to as a homeowner loan.

As well as a homeowner loan, secured loans may also be referred to as a home equity loan or a secured debt consolidation loan. It is important to remember that not all debt consolidation loans are secured, however. If you acquire a loan against your property and don’t have a mortgage, then the secured loan may be referred to as a first-charge loan. If you do have a mortgage, then a secured loan may be called a second mortgage or a second-charge loan.

Make sure you choose the right type of loan for your needs. Before opting for one loan, make sure you know the pros and cons of each loan – reading practical guides such as this one can help before you end up with a loan that doesn’t suit your needs. There are many second charge lenders within the market, most of whom you’ll need to use a broker to apply with them.

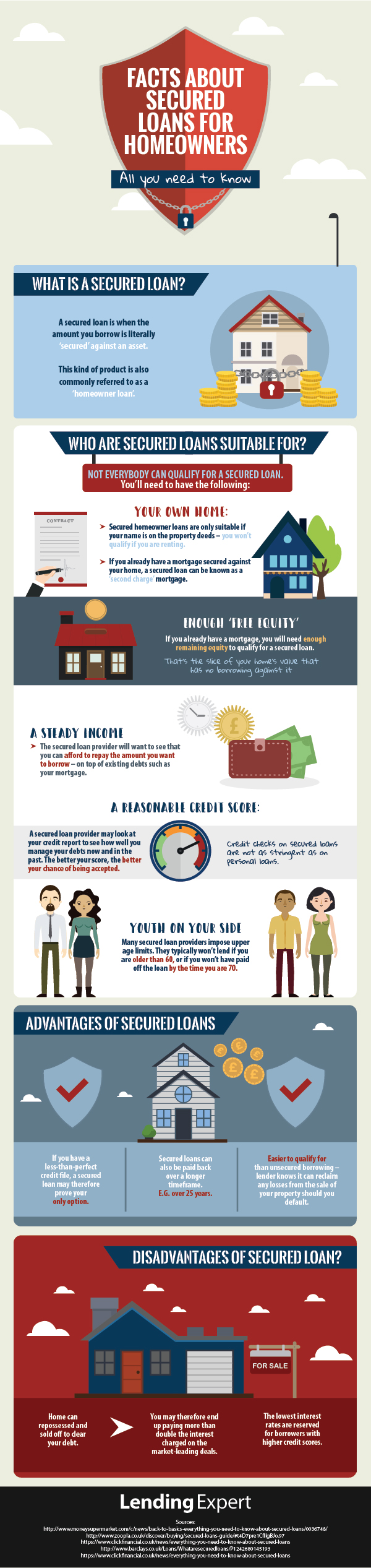

Infographic: Secured loans for homeowners

Infographic: Secured loans for homeowners explained

How much can I borrow against my property?

How much can you borrow against your property?

Usually, secured loans are available so that you can borrow a more considerable sum of money. While secured loans tend to start at around £3,000, most secured loans are for lending over £10,000. Secured loans allow you to borrow more substantial sums of money because lenders have collateral to cover the loan if you cannot pay it back.

A secured loan typically has cheaper loan terms and interest rates as they are less risky to loan providers as they can repossess your asset should you not be able to pay the debt back. However, what it less dangerous to the loan provider could be more risky to the borrower. After all, like a mortgage you could lose property via repossession if you do not keep up with your loan repayments, or fail to repay what you owe.

While the amount you can borrow is usually high for a secured loan, it is essential to consider how much you actually need. Remember, if you cannot meet the repayments and fall behind in arrears, then the loan provider has the right to repossess the property you used as security. This means you may lose your home in the worst case scenario.

Secured Loan Calculator – how much will it cost?

This calculator will give you an idea of costs. The exact amount and APR payable will be provided from the lender subject to credit and affordability checks.

Your monthly payment will be:

Interest on this loan will be:

Annual Percentage Rate (APR):

Total repaid will be:

Loan to value

Your home will be valued to establish how much equity you have

Like a mortgage, a secured loan is secured against the available equity in your home. There are a handful of lenders who borrow up to 95% loan to value, and some who will borrow at 100% with additional security. These high loan to value products come with much higher rates of interest when compared to 85% or 70% loan-to-value products for example. The role of the loan broker as part of the fact finding is to establish an estimate of the available equity and to discuss with you how much you could potentially borrow based upon the figures. At this time they will also provide details on the lenders and rates available given the information provided.

Home valuation

As part of the application your home will be valued by a qualified surveyor in order to establish the true value of your property. The valuation will then be used by the lender in order to assess the available equity within the property to lend against.

When you are ready to apply for a loan, always make sure to complete the application form carefully. Take your time and double check every detail. If you provide information that is wrong, even by accident, then the provider may refuse your application, and a failed application will leave a mark on your credit score which could impact the next lender you approach. Your broker will be on hand to assist you, and provide guidance on the information you need to gather to complete the application.

What are secured loans generally used for?

Secured loans can be used for a number of different (legal) reasons, and as the lender has an asset as security for the loan, they are often very flexible in what the loan can be used for. Some people use a secured loan for expenses such as;

- Home improvements

- Car purchase

- Holiday

- Wedding (Also see Wedding Loans)

- Debt consolidation

- Buying a more expensive home

- Buying a second home.

A secured loan can be used for a range of financial needs, but it is essential to consider the risk fully. Is the reason you are borrowing for worth losing your home or another item of value over? Putting your home at risk for a luxury expense may not be the best idea if you have any doubts on your ability to repay the loan.

Always consider the long-term as much as the short-term. Borrowing may seem like a good idea now, but consider whether borrowing will help you in the long-term. It may mean you are worse off financially in the future and there may be a better alternative. Check your sums and your budget carefully.

Secured loans vs unsecured loans

Unlike secured loans, unsecured loans allow you to borrow money without using an asset as security. Unsecured loans are considered a higher risk to loan providers. With this in mind, loan providers will often set higher interest rates and fees for unsecured loans. However, if you cannot keep up with repayments on a secured loan, then the provider can take possession of your assets.

It is worth pointing out that your assets may be seized in an unsecured loan too. However, loan providers must seek permission from the court and are usually only done if your debts are considered unsustainable and long-term.

Another importance difference between a secured loan and unsecured loan is the amount you can borrow. Typically, unsecured loan providers will not be willing to lend as much as they would for a secured loan. Many providers have a limit of £30,000 for an unsecured (personal) loan while secured loans may be willing to lend over £200,000 or more depending on the value of your asset or free equity of your home. Some lenders will provide loans of up to £2 million if your property has high value and you can afford to meet the repayments.

Considerations when choosing between a secured and unsecured loan

How long you need to repay the debt

Usually secured loan providers will give a longer loan term so that you can spread your repayment. Secured loan terms may be up to 35 years while an unsecured loan is typically around five to seven years maximum.

Amount of interest you can afford

A secured loan will often be a better deal in terms of lower interest rates. However, if you want to repay your loan back early, you could potentially suffer from an early repayment charge (ERC’s). The broker will be able to advise if the loan product comes with any charges like this you need to be aware of.

Your credit score

As an unsecured loan is a higher risk, providers will meticulously analyse your credit score before approval. However, a perfect credit score is not as crucial for a secured loan as you have collateral in place in case you cannot repay the debt.

What you can afford to lose

If you cannot keep up with repayments with a secured loan, then you risk losing your home or another valuable asset. An unsecured loan can often be slightly more understanding, and the provider will have to go through the courts in order to repossess your assets to cover the loan.

Remember StepChange, the Money Advice Service and Citizens Advice can all help with advice and support if you are struggling with debt or repaying a loan.

Who can benefit from a secured loan?

Typically, secured loan providers will have some stipulations on who can apply for a secured loan and your broker can advise on the requirements. Different providers will vary their terms on who can qualify for a secured loan. However, typical eligibility requirements will include;

A steady income

Many providers will want to see that you can not only afford the loan but you will be able to keep up with the repayments. Most providers will need to see proof of a steady income. Providers will often have a minimum salary requirement. They will not just check to see if your income will cover the debt, they may also check whether your income can cover your monthly outgoings and the cost of repayments. Self-employed? Some lenders will know that self-employed individuals cannot always show a steady income. However, there are many lenders that have products exclusively focused on the self-employed market. Evolution Money, Promise Money and Willows Finance are just some of the loan providers who offer a secured loans for self-employed people.

A good credit score

When applying for a secured loan, providers will usually run a credit check to see how well you manage debts, both in the past and currently. You have a higher chance of being accepted if you have a good credit score. As secured loans use an asset as the security of debt repayment, many loan providers will allow a less-than-perfect credit score and offer loans with higher rates of interest. To learn more read this guide about secured loans with bad credit.

However, the better your credit score, the more likely it is that you will be accepted and there is more chance that you will be able to borrow a more considerable amount with more favourable terms such as a lower interest rate.

If you do have a poor credit rating and are looking for a secured loan, lenders such as United Trust Bank, Masthaven and brokers Norton Finance all claim to offer secured loans for bad credit scores.

Property

For a secured loan, you must have a substantial asset to secure the loan against. Usually, people use their home or a buy to let property investment to secure a loan. This is why a secured loan is often referred to as a homeowner loan.

If you already have a mortgage, you are still eligible for a secured loan, but this will usually be referred to as a ‘second-charge loan’ or ‘second-charge mortgage’. A second charge mortgage means that if your home is repossessed, the first mortgage lender will have the priority to take what is owed to them, the second-charge mortgage lender will then have the second chance to claim back what is owed to them.

If you do not have a mortgage, then your secured loan may also be referred to as a first charge mortgage. If you are looking for a second-charge loan as your secured loan, then some providers offer specialist second-charge loan packages such as Feasible Loans, Norton Finance & Loans Warehouse.

Equity

As mentioned previously, if you already have a mortgage on your property, then you are still eligible for a secured loan. However, providers will often look for a reasonable amount of ‘free equity’ to secure their loan against. This equity is the percentage of your home that has no borrowing against it already.

Most loan providers will have a cap of the total debt secured against the value of your home. For example, if they put a cap at 85% of your home’s value. Then if your first-charge mortgage is 75% of your home value, then the second-charge mortgage will only be able to lend 10% of your home’s value. Different lenders have different caps, but remember, the higher percentage of your home’s value that you borrow, the higher loan rate you will be offered.

Your Age

There is usually an age limit for secured loans. The younger you are, the better chance you have of being accepted for a secured loan over a long repayment term. While the upper age limit for pensioners will vary between providers, you can expect a cut off age limit between 70 and 80-years-old. Most lenders accept applicants from the ages of 18 and 21.

When it comes to secured loans for pensioners, many providers will offer other products such as equity release and lifetime mortgages. All options have both positives and negatives, and it is essential to understand all possibilities entirely before making a decision.

How much does a secured loan cost?

All loan providers will offer different rates and different deals which can make working out the cost of a loan confusing. Here are a few factors that will change the cost of the borrowing for you;

- The amount you want to borrow

- The length of time you want to borrow for

- Your credit score (better credit scores usually get favourable rates)

- The amount of free equity in your home (if you use the property as security)

- The APR

- Admin and legal fees

- Disbursement fees

- Broker and setup fees

- Early repayment fees (ERC’s)

- Penalties for late or missed payment

- Your asset (property, home or buy to let) if you do not repay the loan.

How to get the best deal for your secured loan

Before you begin searching for a secured loan, you need to know what you are looking for;

1. Decide how much you need to borrow

2. Check your free equity and loan to value on your property

3. Budget- work out how much you can afford for monthly repayments

4. Check your credit score and fix issues before you apply

To work out your loan to value you need to work out the balance of your existing mortgage and divide this amount by the total value of the property and then multiply by 100, this will give you a loan to value percentage. If you are unsure then speak with a broker who can help you do the calculations and provide you with a personalise quote.

Secured Loan Comparison

Once you have a benchmark, it is time to start conducting comparison searches to find the best deal. There are numerous ways to arrange quotes from different providers. You can start with loan comparison sites like Lending Expert, or if you feel overwhelmed, you can speak to a loan broker who can assess the market to find the best secured loan product for your needs.

Depending on your interest rates, it may be more economical to use savings to cover the debt. Usually, the interest charged on a loan is more than you will gain through savings. Instead of using savings for a rainy day, have a credit card that you can stash away for emergencies instead. This way you can reduce the amount you will pay in interest rates.

Never rush into a loan. Always take your time to assess your finances and seek professional advice where possible. When borrowing for a high purchase always ask yourself: Is this purchase essential? Then ask yourself if you can really afford it or whether there are cheaper options available to you.