>> FREE Mortgage Brokerage For First Time Buyers

>> FREE Mortgage Brokerage For First Time Buyers

According to a report by Yorkshire Building Society, 56% of adults believe owning their own home is essential to feeling successful in life. In addition, they found that 50% of young adults considered homeownership to be more important than getting married or having children.

Given the intense emotional importance placed on owning your own property, it is vital to remain objective and financially astute when arranging your mortgage. After all, it is a significant loan you will be responsible for and one that lasts for many years. Because of this, it is crucial to be well-informed of the three Ps:

- The core principles of mortgages

- The procedures for applying

- The various products that are available to first-time buyers.

This guide is designed to help you navigate the complex offers and schemes available to first-time buyers. This guide will begin by helping you decide if a mortgage is right for you. If it is, then you can understand the various products and services available to you, in easy-to-understand, no-nonsense language. To top it off, the guide will help by advising you on how to make the strongest mortgage application possible, to reduce the likelihood of being declined.

Along the way, look out for our handy tips on saving yourself time, money and stress!

Eligibility

Am I eligible for a mortgage?

While lenders have unique eligibility criteria; there are a few common golden rules. You will need to be at least 18 years old, and often should be no older than 75 by the time your mortgage completes. Broadly speaking, you should be a UK resident with a positive, consistent and checkable credit history. You will need to have saved an acceptable deposit and, crucially, you must demonstrate that you can comfortably afford your monthly mortgage repayments for the lifetime of the loan.

Is buying a property always the best option?

Although we frequently imagine homeownership as a ‘rite of passage’, it is not always the right path for everyone. There are a few notable benefits of renting. For example, when renting, you are not liable for any property maintenance costs. Also, you have the flexibility to downsize or move with ease.

If there’s any doubt about your ability to repay a mortgage, you should consider saving for a more considerable nest-egg or improving your income before buying or simply remain with renting. Read on, and we will help you decide if a mortgage will be affordable for you.

Affordability

Can I afford a mortgage?

Before the https://feasible.co.uk/the-mortgage-market-review-explained/”>2014 Mortgage Market Review, lenders typically allowed applicants to borrow five times their annual salary. However, a good wage no longer guarantees that you will be granted a mortgage. Since the financial crisis, the mortgage lending processes have become increasingly stringent. The most important change to be aware of is the introduction of comprehensive affordability assessments.

What are affordability assessments?

In addition to standard credit checks, lenders will ask you to provide full details of your annual income and annual expenditure. Proof of income is typically required in the form of payslips and a P60. Proof of expenditure (bills and debts) is necessary in the form of bank statements; underwriters study these with a fine-toothed comb to calculate your total monthly living costs.

In simple terms, they will create a ‘cash-flow’ calculation. This is completed by subtracting your expenditures from your income to find out if your disposable income is enough to cover monthly mortgage repayments.

In practice, it is a little more complicated than this. Lenders will also ‘stress-test’ your finances to see if you could still meet your repayments if you suffered a few months unemployment, or if interest rates suddenly rose.

When calculating your expenditures and liabilities, lenders usually include unused credit facilities. For example, if you have a credit card with a limit of £10,000, but it only has a balance of £2,000 on it, they will assume liability for £10,000 when calculating your affordability assessment. It is a smart idea to cancel all unused credit facilities and pay off all debts you can afford to pay off before making a mortgage application.

However, it is also worth bearing in mind that the use of a credit card can often improve your credit score as you consistently pay off the debt in good time, which can actually serve you better than having no reason to use a credit facility at all.

Conduct a statement of affairs

Conducting a statement of affairs simply means running an affordability assessment on yourself. This will empower you to approach mortgage lenders with realistic budget expectations. You will know exactly what you can, and cannot, afford.

Using a pen and paper (or this online form), subtract the total of your expenses (bills and debts) from your income to find your disposable income. Remember to be honest with yourself and include all expenses from gym memberships to socialising costs, and even lottery tickets.

Remember, once you have found your disposable income, you should reduce this amount by 15% to allow for the ‘stress-tests’ performed by lenders. So, if you have got £800 left after paying all debts, bills, and living costs, most lenders will consider an affordable monthly mortgage budget to be £680.

How much deposit will I need?

Lenders favour first time buyers with large deposits. Not only does a large deposit demonstrate you are financially savvy, but it also provides greater protection for them in case you fail to make your mortgage repayments, and they are forced to go through a lengthy repossession process.

Given the current lending climate, you will need at least a 5% deposit, which is a 95% mortgage. In fact, if your credit rating is any less than perfect, most lenders will want to see a 10% deposit or a 90% LTV mortgage. Indeed, many applicants scrimp to save considerably more than 10%, because the more significant your deposit, the better and lower the interest rate will be!

It is worth checking comparison sites to find the best interest rates for your deposit.

As of April 2018, the average repayment interest rate on a bank mortgage with a 5% deposit is approximately 3.3%. However, once the deposit is increased to 10%, the interest rate is nearly halved to roughly, 1.8%. Clearly, this translates to significant savings over the lifetime of the loan.

If you can spare the time, it may be worth holding out a few extra months to increase your deposit offering by just 1 or 2 percent. It may not sound like a significant difference, but studies have shown that offering an 11% deposit (instead of a 10% deposit) can have a considerably positive impact on the outcome of your mortgage application.

Don’t get confused if you hear lenders talking about the Loan-to-Value ratio (LTV), instead of the deposit. An LTV represents the relative ratio of the loan (mortgage) compared to the overall value of the property. So, if you have a 10% deposit, your LTV is 90%. LTVs are useful because they account for both cash deposits and existing equity, so can refer to first-time mortgages as well as re-mortgages.

Mortgage calculator – how much will it cost?

How can I increase my deposit?

Given that, in 2017, the average first-time buyer placed a deposit of £30,000 to secure their chosen property, saving for a deposit is no easy feat.

As mentioned, an excellent place to start is to take a good, hard look at your outgoings and see if there is anything that can be removed or switched to a cheaper alternative. If you have ditched the foreign holidays and forgone as many takeaways as you can bear, and you are still struggling, consider saving with a government initiative to boost your deposit funds.

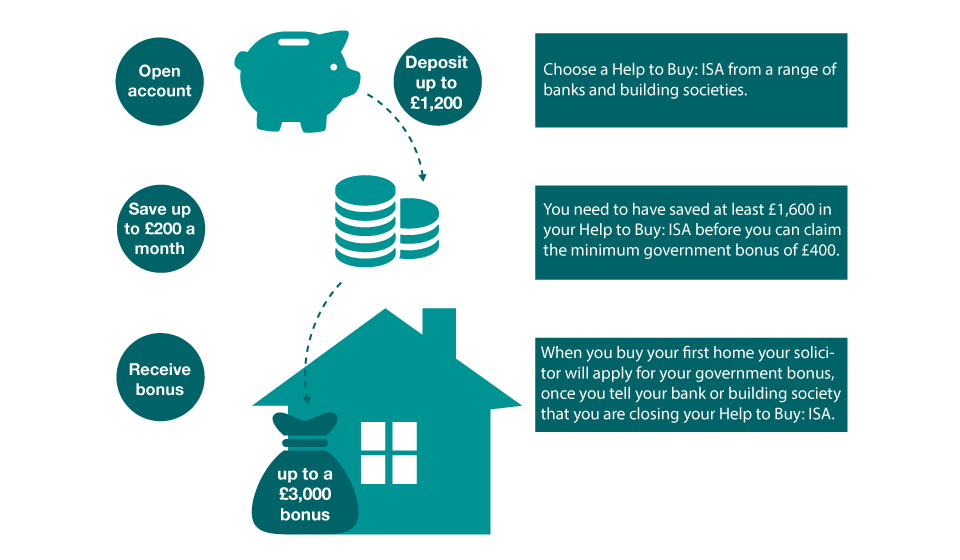

Help to Buy ISAs

The government introduced the Help to Buy ISA in 2015. Anyone above the age of 16 is eligible, and you will receive an annual interest rate of approximately 2.27% on your savings. Crucially, if your savings are used towards a deposit payment, the government will add an additional bonus interest payment of 25%. The maximum bonus payment you can receive is £3,000. You would need to pay £12,000 into the ISA to receive this bonus.

While these ISAs are helpful, it is essential to start saving as early as possible to reap the benefits. In the first month of opening the ISA, you are allowed to deposit £1200. After that, you can accumulate a maximum of £200 per month. As such, it would take the full five years to save £12,000, and therefore be eligible for the £3,000 bonus.

Lifetime ISAs

Initiated in 2017, the Lifetime ISA allows you to save up to £4,000 per year. The government will pay a bonus interest payment of 25% per year. The current maximum bonus payment is £33,000.

Lifetime ISAs are available to 18 to 40-year-olds and can be used towards a deposit if the property is worth less than £450,000. Ironically, the Lifetime ISA seems to have more earning potential for first-time buyers than the Help to Buy ISA so is certainly worth considering. You can read more information on the initiative here.

It is not necessary to arrange your mortgage at the same bank you have registered your ISA with. It is often worth looking around for the best deal.

Budgeting

Budgeting for mortgage fees

Do not forget to budget for mortgage fees. Often, lenders require a ‘booking fee’ of between £99 and £250 to begin processing the mortgage. This will usually be charged after a positive decision-in-principle has been made, so you can be somewhat confident they are happy to lend to you. However, if the mortgage does fall through, this booking fee is usually non-refundable.

Arrangement fees

Once a mortgage has been approved, there will often be an ‘arrangement fee.’ This can vary from £50 to £2,000 and can sometimes be added to the mortgage. This means you will be charged interest on the arrangement fee and it will extend the lifetime of the mortgage. However, it means you will not need to pay anything upfront. As you are a first-time buyer, you will sometimes find banks wave the arrangement fee or offer a reduction, so keep an eye out for these special deals.

Valuation and surveyor fees

Also, banks will carry out a valuation to check what the property is worth. Often, they will cover this cost themselves, but some lenders do charge applicants between £150 and £1,000 for this.

Broker fees

If you opt to work with a mortgage broker, request an outline of their fees before committing to anything. While some brokers will charge a flat-rate upfront fee, others will charge after an agreement-in-principle has been made, and others like Mojo Mortgages and L&C Mortgages might work entirely on commission from the lender so their is no cost to you.

Finally, mortgage lenders will require you to have home and buildings insurance, to protect their investment. Make sure to budget for this expense early-on, so you are fully aware of financial your commitments.

Remember, if you choose to work with a mortgage broker, it is advisable to go with a whole-of-market broker (the type who usually do not work on commission) because they will have many deals to choose from. Which mortgage brokers are a whole-of-market broker who offers impartial services at a fixed cost of £499. However, there are also many others. It may seem counterintuitive to pay for brokering services when some brokers are providing their services for free, but often it is a worthwhile investment.

Lending Expert

This provider is our Expert’s Choice in its category as it won tops marks for the following.

- TRUST

- VALUE

- EXPERTISE & KNOWLEDGE

- CUSTOMER SERVICE

Learn more about how we review and assess the providers here on Lending Expert.

LTV

60% - 100%

Initial Rate

1.19% - 4.32%

Standard Rate (SVR)

3.94% - 4.79%

APRC

3.6%

Type

Variable & 3 ,5 & 10 Fixed Rate

The mortgage experts at First Choice Finance can quickly assess your requirements and search the market place to find you the perfect mortgage deal. Click get a quote to make an enquiry today.

Budgeting for house purchasing

Aside from arranging the mortgage, there are other costs to consider when buying your first property, such as removals, conveyancing and stamp duty.

Conveyancing fees will typically cost upwards of £1,400, so must be budgeted for. It is worth asking for several quotes and not just going with the conveyancer your estate agent recommends, as this could save you hundreds of pounds.

Thanks to stamp duty relief for first-time buyers, you will pay no stamp duty if your property is under £300,000. If your property is worth more than this, you will need to allow room in your budget for between 2% and 5% taxation on anything above £300,000.

Alternative Options for First Time Buyers

If a traditional mortgage seems out of your reach, there are some more affordable options on offer. Here we will cover the pros and cons of each of these ‘alternative’ routes onto the property ladder.

Help to Buy scheme

Launched in 2013, the government Help to Buy mortgage scheme that allows first-time buyers with a 5% deposit to purchase specific newbuild properties throughout the UK. As with all standard mortgages, you will need a good credit rating, and you will need to pass affordability assessments.

Within this scheme, the government invests a further 20% of the properties’ value. This boosts your overall deposit to 25%. This would give you access to the preferential interest rates associated with this level of deposit. Remember, this cash injection is an equity loan that must be repaid. However, it is interest-free for five years, allowing you the grace period needed to start making a dent in your capital mortgage repayments.

After five years, you will pay a relatively low 1.75% interest. Because you are only repaying the interest, the government will still own 20% of your property until you pay them off (either by selling or requesting a valuation and paying them off with savings).

>> FREE Mortgage Brokerage & Advice For Help to Buy Applicants

>> FREE Mortgage Brokerage & Advice For Help to Buy Applicants

The Help to Buy scheme is a good option for some people really struggling to save more than a 5% deposit. It gives you access to good quality new build housing. However, because new build properties are priced at a premium, they do tend to ‘lose’ some value in the first few years, so Help to Buy is generally best suited to homebuyers looking for a long-term home.

Shared Ownership schemes

A survey by Yorkshire Building Society found only 3% of respondents would consider a shared ownership scheme.

Housing associations typically offer shared ownership schemes. You would own between 25% and 75% of the property and pay rent on the remainder of the property. You are usually given the opportunity to increase your ownership in stages, so eventually, you could ‘buy out’ the housing association.

While not ideal, these schemes can provide easier entry onto the property ladder as the deposit requirements will be less. Also, you can usually sell your property at any time, thereby cashing in on your part of the equity share. If you invest in an area that sees an increase in property prices, this will reap financial rewards when you come to sell.

Buying with friends

So-called ‘mates mortgages’ are slowly becoming more popular in the search for affordable housing. You will need to consider bigger properties if you are buying with friends and this could increase associated fees such as stamp duty. Also, you must consider what you would do if the friendship broke down. Having a comprehensive contract drawn up by a solicitor can help take some of the risks of out these types of arrangements.

The bank of mum and dad

Perhaps this one should have been at the top of the list, considering 4 out of 5 young adults now believe they would need some financial help from their parents to secure a mortgage. According to some, this is making the housing crisis even more unfair for middle-to-low income families who simply cannot afford to offer financial support to their adult children. If you are lucky enough to be able to receive financial help from your parents, there are a couple of ways they can help.

The most common way parents can help is by gifting or loaning money towards your deposit (no deposit – 100% mortgages). If your parents are gifting the money, they will need to write a letter to confirm this as your lender will want to be sure they will not try and claim a financial interest in the property.

Alternatively, there are a small number of guarantor mortgages available from lenders such as Aldermore. Because the bank will take your parents’ income into account, this will have a positive impact on your affordability assessment. Be warned; if you are unable to meet your repayments, your parents will be financially liable.

Aldermore guarantor mortgage product

Available via broker only

Available via broker only

Aldermore

LTV

100%

Initial Rate

5.18%

Standard Rate (SVR)

5.73%

APRC

5.9%

Type

Guarantor Mortgage

Aldermore provide a family guarantee mortgage that allows you to get a mortgage without a deposit. Aldermore will require a guarantee against the home of your parents or grandparents for additonal security against your mortgage.

The guarantor mortgage is slowly becoming replaced with the joint mortgage. Some banks will allow you to make a joint application with your parents which will boost the amount you can borrow. Crucially, because only your name will be on the deeds, your parents would avoid most of the taxes associated with owning a second home.

Finally, mortgages such as the Barclays ‘Family Springboard Mortgage’ allow your parents to offset their savings against your mortgage deposit. They will need to be prepared to offset the money for a period of three years, where they will earn a modest amount of interest. If all is well after three years, their money will be returned. This option is excellent for those wanting indirect help getting on the property ladder.

Barclay’s family springboard mortgage product

Available via broker only

Available via broker only

Barclays

LTV

100%

Initial Rate

2.69%

Standard Rate (SVR)

2.99%

APRC

3.0%

Type

Guarantor Mortgage

Barclays have a selection of high 100% loan to value guarantor mortgage options for customers with no deposit. Their spring board mortgage helps customers get a mortgage with the help of a family member.

Starter Home scheme

The Starter Home scheme is a new government initiative being launched in 2018. You will need to be aged between 23 and 40 to be eligible. The project is designed to offer up to a 20% discount on properties for first-time buyers. Keep your eyes peeled for more information on this scheme over the coming months.

Buying your council home

>> FREE Mortgage Brokerage For Right to Buy Mortgages

>> FREE Mortgage Brokerage For Right to Buy Mortgages

If you have been renting your home from the council or local authority and you now have the right to buy your home you will need a lender who accepts mortgage applicants under the right to mortgage buy scheme. Under these schemes you are entitled to a discount of around 35% and most councils require you to have lived in the property for at least 5 years. A broker will be able to assist you in finding the best type of lender.

Choosing your first mortgage

There is no one-size-fits-all mortgage. As a mortgage is a loan secured against your home, it is essential to consider all the options before selecting the right one for your circumstances.

Interest-only or repayment

As the name suggests, on an interest-only mortgage you will only pay back the interest accrued each month. Your monthly payments will be low, but the capital loan will not be reduced. Interest-only mortgages are rarely offered to first-time buyers nowadays unless you have an excellent credit rating or can provide evidence you will receive a lump sum in the near future to clear some or all of the loan.

As such, repayment mortgages are the standard option for most first-time buyers. You will pay interest on your loan, but you will also pay off the capital loan too, usually over a period of 25 years. For the first 5 or so years, it will seem like your repayments are not making much of a dent in the loan. This is because they will mainly be going towards paying the interest on a large loan. Gradually, as time goes on, your monthly repayments will start paying down the debt at a faster rate.

Fixed or tracker

A fixed-rate mortgage guarantees a specific interest rate on mortgage repayments, usually for a period of 2, 3 or 5 years. Regardless of whether interest rates rise or fall during this period, your rate will not change. At the time of pricing, fixed-rates are slightly more expensive than contemporary tracker rates. This is to reflect the protection you will receive against interest rate hikes.

Tracker mortgages, on the other hand, track the Bank of England base rate, so could go up or down. If you are someone that likes predictability, a fixed-rate mortgage is likely to be suitable for you. Moreover, if you are already financially stretched, you will not want to risk being stung by interest rate rises on a tracker mortgage. Many first-time buyers find fixing their repayments is a stable ‘introduction’ into the world of mortgages, particularly as your repayments will be high to begin with. Later on, once you have built your confidence, you may feel more comfortable dabbling with tracker mortgages.

On the other hand, if you have got a healthy budget and lots of wiggle room with your monthly finances, a tracker mortgage offers the potential for paying less (should interest rates be in your favour).

If you opt for a fixed-rate mortgage, there is no need to stay with the same mortgage provider after your fixed-rate period has ended. Once you have completed your introductory 3 or 5-year fix, you will usually revert back to the pricier standard-variable-rate (not quite the same as a tracker mortgage), so it is worth looking around again for a better deal.

Overpaying your mortgage

Many people consider overpaying as a way of shortening the term of their mortgage. This is a great thing to do if you can afford it. When considering a mortgage product, it is important to ask about early repayment charges. Depending on the mortgage you choose, some banks may charge between 1% and 5% in early repayment charges, particularly during your initial fixed-rate period.

Some banks will let you overpay up to a specific amount per year (typically up to 10% of your total debt). If you know your income is likely to increase in the near future, look out for mortgages with favourable early repayment conditions.

Finally, some banks also offer a ‘borrow back’ facility, allowing you to borrow back the money you have overpaid if you suddenly need the funds for something else. In an uncertain and highly volatile economic climate, this additional feature offers great flexibility and peace-of-mind for mortgage holders.

Porting

If you think you may move to a new house, especially during the fixed-rate period of a mortgage, it is imperative to find a mortgage that can be moved (ported) to another property.

While it is possible to arrange a mortgage without receiving any advice, first-time buyers will benefit greatly from the experience of a mortgage advisor or impartial broker. A credible mortgage specialist will be able to explain the pros and cons of all types of mortgages and recommend a product most suited to your needs.

Applying for a mortgage

How can I make a strong mortgage application?

According to a recent report, the second most significant barrier to applying for a mortgage is the fear of being declined. It is important to sort out your finances before making a mortgage application, to give yourself the best possible chance of acceptance.

Credit Report

Order a free copy of your credit report from Experian, Noddle or Clearscore. You should scrutinise everything on your report to check it is correct. If anything is incorrect, you will need to write to the credit reference agencies to get this information amended. If your report shows financial links to ex-partners with bad credit histories, you can also ask for this link to be removed.

It is worth sending your request by recorded delivery and regularly chasing as credit reference agencies have a reputation for being quite unresponsive at times.

Credit

Try and clear any balances on credit cards, loans or store cards before applying for a mortgage. In addition, close any unused accounts, or reduce the credit limit. Remember, lenders include unused accounts when assessing affordability. In particular, clearing your overdraft is advisable because this will show you are not living beyond your means. Steer well clear of payday loans or high-interest loans as most lenders will decline your application if you have had one of these in the last 12 months. Tip: Remember, if you plan to make a joint mortgage application, make sure your partner follows these recommendations too.

Poor credit options

If you have a poor credit history or a low credit score then you options will be more limited and you can expect to pay higher fees and rates of interest. Using a broker in instance will be far more beneficial as they will be able to search through lenders who are likely to accept your application. There are lenders who lend to adverse credit applicants, and there are also a range of lenders who offer mortgages with a guarantor which may increase your chances of getting the mortgage you require. If you are in no rush to take out a mortgage right away, then your time may be best spent cleaning up your credit rating and improving your credit score prior to applying for your first mortgage.

Electoral Register

It is crucial your electoral role information be up-to-date. You can check whether you are registered on the electoral register by looking at your credit report or contacting your local council.

Your Reputation

Consider your reputation with lenders. If you have been with the same bank your whole life, and you have banked responsibly, they may be your best bet for securing a mortgage (even if they are not able to offer the best deal). Moreover, if you have opened a Help to Buy ISA with a particular bank such as Nationwide (and added funds regularly), they may be more likely to prioritise your mortgage application over other applicants who have not built a reputation with them.

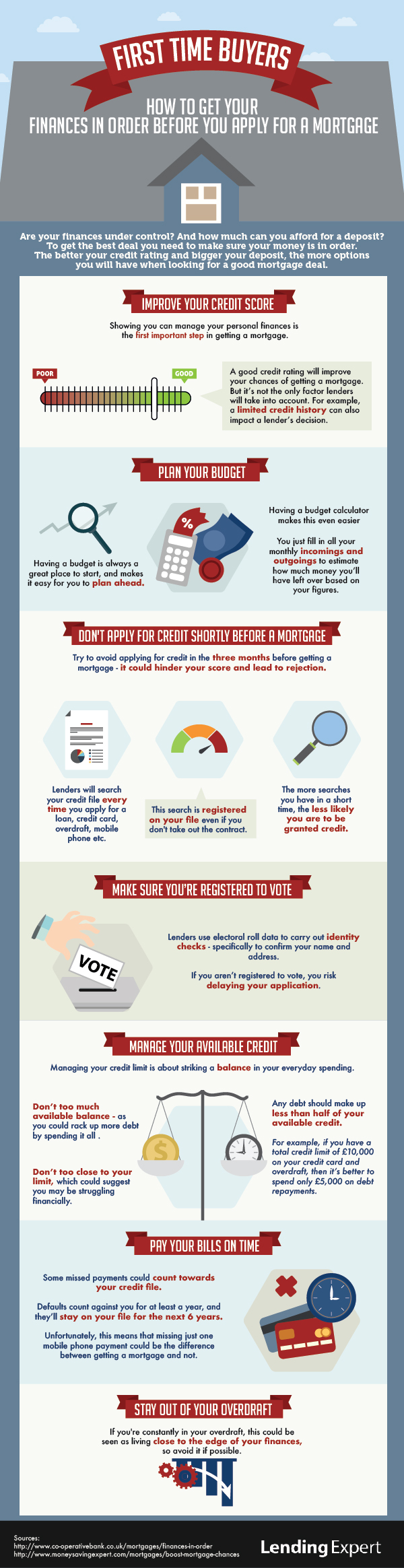

Infographic: How to get your finances in order for first time buyers

An infographic that explains how to get your finances in order before you apply for your first mortgage.

How to apply for your first mortgage

There’s a number of ways to apply for a mortgage. You can choose a broker to assist you or book an appointment with a mortgage advisor at your chosen lender. Increasingly, mortgage appointments can be conducted flexibly, over the phone or even online through broker services such as Life’s Great.

Decision in principle (DIP)

While it is not necessary, many people will choose to apply for a decision-in-principle before looking for a property to buy. A decision-in-principle is a statement from a lender to say that, in theory, they would be happy to lend you ‘X’ amount of money. You can book an appointment with your lender to carry this out, though most banks allow you to apply for a decision-in-principle through a simple online form.

<p “class=”tips”>Do not apply for too many in quick succession. Lenders will conduct a credit check when processing a decision-in-principle and too many checks can negatively impact your credit rating because they make you appear desperate. If you are declined for a decision-in-principle, take a look at your credit report and statement of affairs to see if you can detect the issue. If not, call the lender to ask for feedback before making any further applications.

Full application

You will need to have had your offer accepted on a property before you can submit your full mortgage application. Once you are happy to go ahead, there may be a mortgage arrangement fee and/or valuation fee charged by your lender.

Lenders will require documentation from you to process your mortgage application. This varies between lenders but typically includes:

• 3 – 6 months’ pay slips

• Latest P60

• 3 – 6 months’ bank statements showing

• Copy of ID such as passport or driving licence

• Proof of deposit funds – such as a letter from the donor or a bank statement

• Proof of bonuses/commission or any additional income cited in your application.

Once your mortgage has been accepted, you should hire a conveyancer to initiate the purchase of the property.

Self-employed applicants

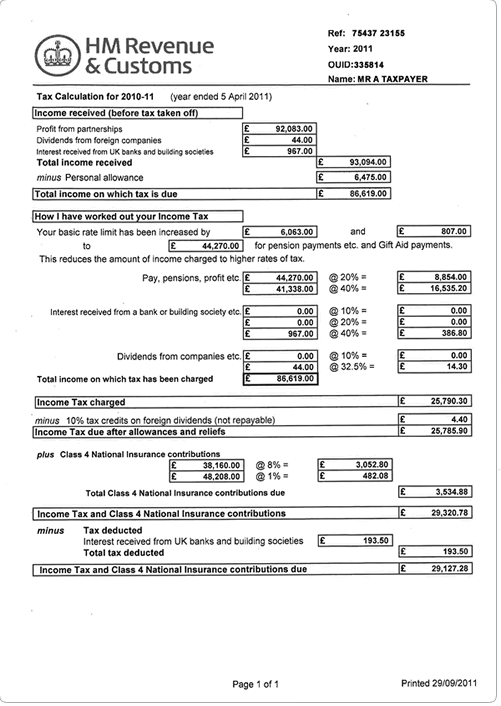

If you are self-employed, be prepared to provide additional documentation when applying for a mortgage. You will need to provide two to three years of business accounts, so this often excludes new business owners from applying.

Lenders will also want to see your SA302 tax returns as evidence of income. These are issued by HMRC but can take quite a few weeks to process, so you should plan your application in advance.

The SA302 document from HMRC will be required to show proof of income

Self-employed mortgages are often more complex to arrange, so it is beneficial approaching specialist lenders such as Aldermore or brokers for assistance.

Should I use a mortgage broker?

The benefit of using a (good) broker is that they can often speed up your mortgage application. However, it is advisable to select an independent, whole-of-market broker as they are more likely to secure the best deal for you. In addition, brokers are often invaluable for complex mortgage applications, such as self-employed or poor credit mortgages.

That is not to say that hiring a broker is always necessary. The availability of online mortgage comparison sites means you can compare most deals online for free. If you are confident you meet a lenders’ eligibility requirements, you are happy you have found a good mortgage deal, and you have all documents to hand, there’s no reason why you cannot apply directly to a lender.

Just because the Financial Conduct Authority regulates a broker, this does not mean they are impartial. Look out for independent, whole-of-market brokers.

Choosing a property

In a recent report, 33% of people surveyed said that buying a property in their local area was too expensive. Indeed, properties in London and the South East are unaffordable for many first-time buyers. If your lifestyle allows it, it may be worth considering buying further afield, especially in ‘up and coming’ property hotspots. Sites such as Zoopla frequently publish lists of lesser well-known ‘value for money’ locations tucked away between more expensive areas.

If you are buying with a small deposit, it is important to remember that new builds may lose a proportion of value within the first few years. If you are not planning to stay in the home for at least five years, you might find yourself in negative equity.

It is worth noting, lenders do not automatically approve mortgages for all types of properties. For example, some will not provide mortgages on ex-council houses or flats above commercial premises. Also, some will not lend to blocks of flats without lifts. Ask your chosen lender or broker about their restrictions; this will save you lots of time when house hunting!

Looking Ahead

Hopefully, this guide has helped you decide whether a mortgage is right for you. We have tried to provide an impartial description of all the options available in the hope that one will suit your needs.

If we had to choose one piece of advice to offer you, it would be, always do your research. This might involve investigating new government initiatives, searching for alternative buying schemes or seeking out the best mortgage rate for your individual needs. Indeed, the fun does not stop once you have been approved your first mortgage either. Whichever initial mortgage deal you chose, it is always worth considering re-mortgaging further down to the line to guarantee the best rate.

Nonetheless, once the dust has settled, do allow plenty of time to enjoy your first home.

One Response to A Guide to First Time Buyer Mortgages: [Read All You Need to Know]